How Much Does Health Insurance Cost Per Month - Questions

I pay a $15 Co-Pay each time. All of my x-rays are: No Charge! I picked an In-Network Humana Dental Company near my house. I receive a 25% discount if I go to a specialist.' The biggest grievances are https://www.businesswire.com/news/home/20190723005692/en/Wesley-Financial-Group-Sees-Increase-Timeshare-Cancellation to do with bad client service by means of telephone, and call center personnel not effectively understanding the various dental plans on offer.

The PPO and DHMO choices are limited to just 2 strategies, but preventative care is covered. MetLife Dental Insurance uses 2 kinds of plans: a Dental PPO Plan and an Oral HMO/Managed Care Strategy. The latter is available in California, Florida, New Jersey, New York and Texas. With these plans, you do not have deductibles or claims kinds to deal with, but you must choose an in-network dentist when enrolling.

Consisted of orthodontics make it perfect for households who have children in need of braces, while low copays assist it attract anyone wishing to make a decent saving on oral care. With as much as 45% to be saved, this is among the better choices out there, covering over 400 procedures and a network of 90,000 dental experts.

web. You'll get multiple quotes to compare dental plans that better match your needs and budget.VIEW DEAL ON HealthInsurance. netRated at Scores via Like a great deal of the huge dental health insurance companies, MetLife has actually is rated A+ at the Bbb, and has a 4. 4 star ranking at Consumers Advocate.

Some applauded the service received, while others were irritated with long haul times on phones, and absence of payments where cover was allegedly not relatively dealt out. Positive evaluations on ConsumerAffairs specified that, 'There was never ever a problem with claims processing,' which the policy was, 'an include on to my existing health insurance through my employer.

The service provider holds an A+ rating with the Bbb, plus premium scores for financial strength and stability. There are a large range of oral intend on deal here, with a simple search function accessible via the website so that you can discover a dental professional within the 100,000+ specialists listed as in-network.

Our What Is The Difference Between Whole Life And Term Life Insurance Diaries

Guardian Direct Dental Insurance strategy expenses are reasonable, with plans beginning for as little as $16 per month. You can access as much as 35% discount rates on some treatments, with sensible copay alternatives for larger oral treatments. The Guardian Dental site provides three detailed mini Q&A s to help you discover the right oral protection.

Compare Dental Insurance Coverage QuotesCompare Guardian Direct Dental against other companies using HealthInsurance. internet. You'll get several quotes to compare oral plans that better match your needs and budget.VIEW OFFER ON HealthInsurance. netRanked at Ratings at Depending upon which site you search, Guardian Direct Dental Insurance coverage evaluations are also extremely blended, which is fascinating.

8 score out of 5. One current review stated that, 'I'm so thankful that my company picked Guardian Dental as our company - they have actually covered a lot and even have a rollover plan that has come really helpful when I maxed out my yearly advantage.' Other consumers were dissatisfied with the customer service, grumbling that staff need to be more clear when discussing advantages, caps and reimbursements.( Image credit: Delta Dental) Wide strategy varietyFree x-raysNot all procedures are approvedAvailability varies by stateDelta Dental is one of the largest oral insurers in America, covering all 50 states, and has 6 different strategy choices.

There are over 340,000 dentists in the Delta Dental PPO and Dental Dental Premier Plans, so you'll hardly be stuck for choice. Just like all of the best dental insurance companies, plans and the specific levels of coverage differs by state. Rates differs on where you live too. Preventive care such as cleansings and X-rays are covered at 100%, and all basic and more extensive dental treatments and services such as crowns, root canals and dental implants are covered at approximately 50%.

There is a state by state variation on schedule, however with over 78 million people utilizing Delta Dental Insurance coverage, it's clearly doing something right. Cover not only works for individuals but likewise encompasses households and can be accessed via your company too. Compare Dental Insurance QuotesCompare Delta Dental versus other suppliers utilizing HealthInsurance.

You'll get numerous quotes to compare dental strategies that much better suit your requirements and budget.VIEW DEAL ON HealthInsurance. netRated at Ratings at According to Finest Company, Delta Dental consumers are 'Generally pleased with the coverage and service they get from Delta Dental. Reviewers are likewise happy with its big network of oral suppliers.' That stated, some reviewers experienced problems when getting dental procedures approved, causing frustrating delays - how does health insurance deductible work.

The smart Trick of How To Get Free Birth Control Without Insurance That Nobody is Talking About

Delta Dental provides a series of strategies, and the level of client experience differs throughout them. Compare Dental Insurance QuotesDental insurance coverage can be expensive, depending upon where you live and the plan you select, so start your search today at HealthInsurance (how much term life insurance do i need). net and get multiple quotes to compare oral insurance that fits your needs.VIEW OFFER ON HealthInsurance.

When it comes to choosing an oral strategy, make a list of your main oral care requirements and balance those versus a list of 'nice to have' advantages. Believe about whether excellent consumer service and a large network of dental practitioners are essential to you, or whether you just require routine preventive care and low http://www.wesleygrouptimeshare.com/wesley-financial-chuck-mcdowell-help/ regular monthly expenses.

In our experience, we have actually found that most of dentists are familiar with what requirement and full coverage oral insurance coverage reaches and can for that reason talk you through this prior to any treatment is offered. Does the oral insurance coverage provider you're thinking about deal a good choice of strategies in your state? What are the out-of-pocket expenses? Are they affordable? These can quickly add up, so ensure you can get the care you require without having to pay through the nose as soon as you surpass any yearly optimum limitations.

You're paying for this, so only choose an oral insurance coverage supplier that has a great variety of dentists near to where you live. The fact is, the more affordable oral insurance coverage plans typically have more exclusions (ie, what they do not cover), however is this affordable for you in the long run? Well, if your teeth and gums are in health, therefore you only require fundamental check-ups and cleansings, you could be great with one a less expensive strategy.

If you have a pressing need for dental care, we 'd suggest preventing oral insurance plans with waiting durations, otherwise you might be facing a waiting period of as much as one year before protection begins - and you can get the treatment you require. Oral insurance coverage is different to dental discount plans, as the latter only deals minimized rates on services for dental practitioners in a specific network.

These include fundamental, preventive care, through crows and root canals. You pay a monthly insurance coverage premium, and you may even need to pay a yearly or lifetime deductible, plus any copayments, when you check out a dentist for treatment. While the Affordable Care Act avoided any limitations on health care coverage from being applied in a given year, even the very best oral insurance coverage frequently includes annual limitations as low as $750 per person.

Everything about How Much Does Homeowners Insurance Cost

If you're going to spend the cash on long-lasting care insurance, make sure your advantages will be sufficientand offered to support you. Since long-term costs will likely continue their upward climb, you may think about adding inflation defense. Likewise, https://www.pinterest.com/wesleyfinancialgroup/ pick an insurance provider with a strong track record and strong financial health.

Your long-lasting care https://www.springhopeenterprise.com/classifieds/wesley+financial+group+llc+timeshare+cancellation+experts+over+50000000+in+timeshare+debt+and+fees+cancelled+in,212189 insurance coverage ought to fit your individual scenario (how to fight insurance company totaled car). A person may need a different level of coverage than a married couple due to the fact that a bachelor has to think about the long-lasting care requirements of only one individual. For couples, consider the impact on your spouse's financial scenario if you have a prolonged long-lasting care scenario - how much is long term care insurance.

Whose Life Is Covered On A Life Insurance Policy That Contains A Payor Benefit Clause? Can Be Fun For Everyone

Idaho Temporarily remote $25,000 - $36,000 a year Familiarity with health and life insurance coverage strategies. Display insurance coverage declares to make sure shared complete satisfaction. Insurance coverage market: 1 year (Preferred). $52,000 - $150,000 a year Quickly applyResponsive employer To keep everybody as safe as possible, we are permitting representatives to meet customers practically.

Family Advisers Bismarck, ND Momentarily remote $1,488 - $2,390 a week Quickly applyResponsive employerUrgently hiring This is a system that has been proven and recognized in the market as the new period of insurance coverage. Our internal customer demand program and selling system allow Flexibility Riders Norman, OK Approximately $25 an hour Get state insurance coverage licenses (life, and SIE, Series 6 and 63 (Spent for by our business).

Life insurance coverage representatives are persons licensed and regulated by the Financial Providers Commission of Ontario (FSCO) to sell insurance coverage in Ontario. Some representatives represent one insurance provider while others represent several companies. All life insurance agents should have finished the Life Licence Certification Program (LLQP) and have actually passed the LLQP exam, and they are needed to complete 30 hours of continuing education credits every 2 years.

See This Report on How To Become An Allstate Insurance Agent

Ask if they are a Chartered Life Underwriter (CLU), or a Chartered Financial Consultant (CHFC). These programs need numerous years of study and assessments. Additionally, ask if they are accredited to sell other products such as Mutual Funds. A life insurance coverage representative can play an essential function in your purchase of a life insurance policy.

Remember most life insurance coverage agents are paid a commission by the insurance company releasing the policy. To discover a representative near you visit FSCO's Agents Accredited in Ontario. A life insurance coverage company problems and offers detailed financial items including individual and group insurance plan to people and companies, and assures to pay benefits to holders of those policies.

For a list of certified companies go to FSCO's Licensed Insurance provider in Ontario database. FSCO licenses and manages life insurance agents and business in Ontario to make sure customers are protected and to boost public confidence in the insurance coverage sector. Being licensed and regulated by FSCO means safeguards are in location to secure your consumer rights.

The smart Trick of How To Become An Insurance Agent In Ohio That Nobody is Talking About

Check that the insurance coverage representative or company you want to work with is accredited by FSCO. FSCO's Enforcement Online database likewise shows if any enforcement action has been taken versus the insurance coverage representative or business in Ontario. Enforcement actions, like having a license suspension, or the imposition of a fine (Administrative Monetary Charge), may indicate problems in concerns to compliance with legislation that were remediated through these sanctions.

Finding a professional to work with is an essential action. Ask loved ones for suggestions or referrals. Other trusted consultants like the household lawyer or your bank supervisor can help too, and you can likewise inspect the Yellow Pages, expert associations, posts from the media and annual reports from the companies themselves online.

Ensure you call a minimum of 2 or three agents or companies and see if you feel comfy with them. Focus on getting sound recommendations rather than the least expensive premium. POINTER: timeshare financing companies Ask: How long have you been in service? Do you have any recommendations I could evaluate or get in touch with? For which companies do you sell insurance? How/when can I contact you for guidance both before and when I have a life insurance policy? For a complete list of concerns to ask, visit our list of Concerns to inquire about your life insurance coverage.

9 Easy Facts About What Is It Like Being An Insurance Agent Described

It is necessary to be frank and open about your life, health and brief- or long-lasting financial objectives. This will help your agent or business advise choices that fulfill your requirements and situations. You can anticipate that an agent will ask you personal questions, including what you can or can not manage.

Your life insurance representative or company will assist you through the following: This will help you get a concept of your possessions, liabilities (financial obligations) and earnings requirements. When you supply accurate information to your insurance agent or company, they can make better recommendations for a policy that will fit your monetary requirements.

Your insurance coverage representative or business requires to evaluate the threat that you posture to the insurance company. You will probably have to finish a detailed health survey. Be prepared to answer concerns about your age, medical history, your household case history and whether you smoke. how much does it cost to become a licensed insurance agent. Non-smokers frequently get significantly lower premium rates than cigarette smokers.

7 Simple Techniques For How To Be A Licensed Insurance Agent

When you sign your application, you authorize the insurance company to call your doctors, medical facilities and the Medical Details Bureau (MIB). The insurance provider can not decrease your application based upon the MIB report, but they can use it as a basis to ask for additional info or increase your premiums.

Your job, financial scenario, hazardous activities and other factors are taken into account before your application is authorized. Most candidates get the coverage they ask for, and receive "standard" premium rates. If the business believes you present a higher risk, they might charge greater premiums, or change the regards to the policy.

When providing you Helpful site with alternatives and item suggestions, your insurance agent or company need to supply you with written policy illustrations that assistance explain how the items they are recommending may carry out over time depending on interest rates earned within the policy. It is necessary to comprehend that the illustrations are not part of your contract, as not all the features of an insurance coverage policy (e.

9 Simple Techniques For How Do I Become An Independent Insurance Agent

Insurance provider can not predict here the future anymore than you can. They are making an educated guess about how a policy could perform. Make certain you comprehend any assumptions that have actually been made to come up with proposed premiums and advantages by asking concerns to acquire a much better understanding of the risks connected with each policy, and what happens to the different features if these presumptions alter for the even worse (e.

rates of interest reduce). For a complete list of concerns to ask, visit our list of Questions to ask about your life insurance. Don't feel pressured to accept the first policy that exists to you. In fact, don't deal with an insurance representative or company who attempts to sell you a policy without offering options.

The application asks for your individual info such as your name, address, age, etc., and it explains the type of insurance policy for which you are applying. It will likewise request a recipient, your approach of payment and a health survey. Ensure all details is accurate before signing the application, and request for a copy of the finished kind for your records.

The Ultimate Guide To How Much Does An Insurance Agent Make A Year

After you sign the application will then be sent to the underwriting department, where it is reviewed, the threat you position is examined, and a choice is made on whether the policy can be provided on the terms you asked for. You should get your policy within one month of your application.

Indicators on How To Become A Independent Insurance Agent You Need To Know

But make sure your policies are based on a realistic quote of your requirements, and not just on fear. If you have an enduring relationship with your agent, there's no factor to presume that she or he is just after your money. An excellent agent will always advise the finest products for you.

You're the one who needs to deal with the insurance coverage. If you believe your insurance coverage agent has guided you toward a policy that's not right for you, you do have recourse. Get in contact with your state's insurance coverage department though the National Association of Insurance Commissioners. Alice Holbrook is a personnel writer covering insurance coverage and investing for.

Like an auto insurance coverage or health insurance salesperson, a life insurance coverage agent will contact customers and stroll them through the procedure of getting and buying life insurance protection. While some business offer life insurance coverage through an advantages plan, it is likewise available for specific needs. An insurance coverage representative can help clients with the complicated process of submitting insurance forms.

How How Much Does It Cost To Become A Licensed Insurance Agent can Save You Time, Stress, and Money.

A life insurance coverage representative needs to be an excellent communicator and can translate a complex procedure with ease. It takes hands-on training and a state license to become a life insurance agent. A bachelor's degree is suggested, however not required to start. An insurance provider will generally train a new hire, but continued education and courses are needed to meet state requirements for an insurance coverage license and can be discovered in colleges and online.

Life insurance coverage and medical insurance might require separate licenses. As soon as worked with, you will watch a skilled representative to gain insight into the paperwork processes and filing. To be an excellent life insurance representative, you should have exceptional people skills. Talking with customers on the subject of life insurance coverage can be difficult.

Nevertheless, life insurance coverage can attend to member of the family in the future and use a sense of convenience in the present. An excellent life insurance representative comprehends this necessary requirement and can direct customers through any doubts and discover the ideal policies that work for the clients' lifestyle and financial resources. There are many success stories for life insurance agents, and it is a great task for those looking to assist others.

How To Become A Life Insurance Agent - Questions

Life insurance representatives have task security also, as long as they can find and keep clients. If working for an insurance sales agency, life insurance coverage representatives can make commissions in addition to their incomes. With this Life Insurance coverage Agent job description sample, you can get an excellent idea of what companies are searching for when hiring for this position.

Our insurance coverage firm is looking for a Life Insurance Agent to join our group. what do the letters clu stand for in relation to an insurance agent?. Your job responsibilities involve assisting prospective consumers find the right insurance items to fit their requirements. You stroll customers through the entire sign-up procedure, so you need familiarity with every element of acquiring life insurance coverage. Making cold calls and pursuing leads, both on the phone or face to face, are vital to constructing our client base, so you need to have exceptional communication and consumer service abilities.

Sales experience is a plus. Usage cold calling and direct mail strategies to make salesHelp customers through the acquiring processAnswer any concerns brand-new or existing clients might haveDocument all of your salesMaintain your license through continuing educationA high school diploma or GED certificateAn insurance coverage sales license or determination to earn oneCommunication and sales skillsExperience in medical insurance or life insurance sales (preferred).

How To Become A Progressive Insurance Agent Can Be Fun For Anyone

A life insurance representative is an individual whose know-how remains in fitting customers with life insurance coverage to fit their requirements. These requirements can range vastly, from earnings protection for enjoyed ones in the occasion of an unfortunate death to transferring properties effectively from an estate after death, and even to saving for retirement in a tax-efficient manner.

They might likewise be estate coordinators, trust consultants, and financial investment experts. The objective of every life insurance representative need to be to supply the best recommendations possible to their customers about which life insurance they ought to buy. A life insurance coverage representative need to not attempt to "sell" someone on a policy. They should be more of an expert, discovering as much as they can about a client's way of life and requirements and fitting the suitable policy to them.

Some have years grace gaynor wikipedia of education and experience and work extensively using life insurance to fix advanced needs from customers. Other life insurance agents are bit more than salespersons pressing the very same product on every customer, no matter expense or the requirements of the client. Some representatives who offer life insurance are detailed monetary organizers and utilize life insurance as one option to suit the holistic financial preparation technique.

7 Easy Facts About How To Become A Life Insurance Agent Described

These classifications show to customers of the representative that have achieved them a commitment to excellence. Other representatives just sell life insurance and utilize life insurance coverage as an option even when better or less costly choices might be available. If you remain in the market for a brand-new life insurance representative you must search for an agent with a CLU designation, since this generally is a signal that the agent is professional and likewise probably experienced in the market.

Generally they are professionals in their business' products but understand little about any product offerings from outdoors firms. what is a captive insurance agent. When this is the case, there is a dispute in between the agent and the customer. The customer is relying on the representative to supply the finest advice and the very best product to fit their needs, however the agent only desires to offer life insurance coverage from their own firm.

For some customers, this seems like fitting a square peg in a round hole. No one wants to waste cash by purchasing a wesley group comparable item at a higher rate, however the greater the rate, the greater the commission to the representatives. Not every representative works for one particular business, however to offer life insurance coverage from a business an agent does need to get approved.

Things about What Do The Letters Clu Stand For In Relation To An Insurance Agent

Independent agents siriusxm cancellations or those not tied to one private business are typically the very best ones to deal with. Profession agents for one company can be some of the most well-informed in the market however, and even they can generally draw on several business for term life insurance coverage. Term life insurance is not generally the least expensive from the traditional big companies who specialize in entire life.

We are able to compare life insurance prices quote throughout service providers, which lets you see prices for all equivalent policies. This can conserve you countless dollars over the lifetime of the life insurance policy, or enable you to leave more protection to your loved ones and heirs for a comparable cost.

Even if you currently deal with a monetary adviser, comparing quotes on Life Ant will help you comprehend if you are being priced quote reasonable rates from your advisor - how to become an insurance agent in texas. We do not offer particular financial suggestions, but our company believe the more informed our customers are, the better they will be with their financial preparation.

Getting My Who Does An Insurance Agent Represent To Work

More junior agents can often progress in making potential and obligation if they prefer to do so, as they get more experience in the market. However the important thing to keep in mind about being a life insurance coverage agent is this: When you're a life insurance coverage agent, you're not just selling a product. In later years, the agent may get anywhere from 3-10% of each year's premium, also called "renewals" or "routing commissions." Let's take a look at an example: Bob the insurance coverage agent sells Sally a whole life insurance policy that covers her for the rest of her life as long as she continues to make her premium payments.

The policy costs Sally $100 monthly or $1,200 annually. Therefore, in the first year, Bob will make a $1,080 commission on offering this life insurance policy ($ 1,200 x 90%). In all subsequent years, Bob will make $60 in renewals as long as Sally continues to pay the premiums ($ 1,200 x 5%).

As mentioned before, a life insurance coverage agent is not an occupation for the thin-skinned or faint of heart. In fact, more info more than any other factor, including education and experience, life insurance agents should possess a battling spirit. They must be people who like the adventure of the hunt, the rush of a sale, and see rejection as a stepping stone to eventual success.

The huge majority of life insurance business have no formal education requirements for becoming an agent. While numerous choose college graduates, this basic guideline is constantly overlooked in favor of the "best" candidates. Previous experience in the insurance industry is not required since the majority of medium and large insurance carriers have internal programs to train their salesmen about the items they're going to sell.

Insurance coverage agents are currently licensed by the individual state or states in which they'll be selling insurance coverage. This usually requires passing a state-administered licensing test in addition to taking a licensing class that typically runs 25-50 hours. The sales commission life insurance representatives may earn in the first year if they are on a commission-only wage; that's the greatest commission for any kind of insurance.

Primarily, you'll require to create a resume that highlights your entrepreneurial spirit. how to become insurance agent. You'll desire to consist of anything that reveals you taking effort to make things happen, whether it was beginning your own business alicia mcvey or taking somebody else's company to the next level. Life insurance representatives have actually to be driven and have the ability to be self-starters.

Not known Incorrect Statements About How To Become A Title Insurance Agent

When you have actually got your resume polished, you'll wish to start finding positions and using. It's really essential you do not feel pressured to take the very first position that comes along, as working for the wrong business can both burn you out and haunt you for the rest of your insurance coverage career.

Possibly the very best place to begin in deciding where to apply is to check out the insurer score sites for A.M. Best, Moody's, or Standard & Poor's. From there, you'll have the ability to develop a list of companies that have scores of "A" or greater in your state. These companies will normally provide the most-secure products at sensible rates, with a focus on compensating and keeping quality agents.

When you have actually produced this list, begin looking at each company. Due to the high turnover rate of insurance coverage representatives, a lot of companies prominently publish their task listings by geographical location, which makes them quickly searchable for you. When you discover a business in your location that appears to fit your personality, obtain the position as the business advises on its website.

Many insurance provider recruiters will not even talk to a possible agent who does not first make a follow-up call, since this is a strong indicator of a possible agent's perseverance. During your interview, continue to communicate your entrepreneurial and "never state quit" character, due to the fact that many supervisors will work with someone based on these aspects over all the others integrated.

Your sales supervisor will be the very first to advise you that your only function in life is to find potential customers. In fact, they'll be far more interested in the number of contacts you're making each week than how well you know their item line. Do anticipate to have a hard time financially for the very first couple of months up until your first sales commissions begin rolling in.

Numerous agents are now fortunate to be made up for one to 2 months of training before being placed on a "commission-only" basis. While the life insurance coverage industry pledges great rewards for those who are ready to strive and bear with an excellent quantity of rejection, there are two other pitfalls you require to be familiar with.

Excitement About How Much Insurance Agent Make

While that might be appealing and seem like a great concept to get you started, it can also burn a lot of bridges with people you appreciate. Second, you need to visit your state insurance commissioner's site and have a look at the complaint history versus companies that you're considering working for.

Accepting a job with the wrong insurance provider will go a long way towards burning you out and ruining your dreams of an appealing career. If a profession in life insurance coverage sales is something you truly desire, take your time and wait for the right chance at the best business.

Insurance is too complicated. I'm not qualified. It's far too late to alter professions. If you've ever considered the actions to ending up being an insurance agent, you have actually likely been exposed to these common misunderstandings and misconceptions about offering insurance coverage. To set the record directly, Farm Bureau Financial Providers is here to bust the leading myths about becoming an insurance representative and aid ensure nothing stands in between you and your dream opportunity! The truth is, the majority of our representatives do not have a background in insurance coverage sales.

Though a number of our top prospects have some prior experience in sales, service and/or marketing, specific characteristic, such as having an entrepreneurial spirit, self-motivation and the ability to communicate effectively, can lay the right foundation for success in becoming an insurance coverage representative. From here, we equip our agents with focused training, continuing education opportunities and one-on-one mentorship programs created to assist them learn the ins and outs of the industry.

Farm Bureau agents discover their career course to be satisfying and rewarding as they assist people and families within their community safeguard their incomes and futures. They comprehend that their company is not practically insurance coverage items - it's about people, relationships and making whole neighborhoods healthier, safer and more safe and secure.

Our employee are trained on our sales process which will assist them identify the finest coverage for each client/member or organization. The Farm Bureau sales process begins with recognizing a possibility, whether you're offering a personal policy or a business policy. From there, you can learn more about the prospective client/member, find their requirements and determine their long-term objectives.

What Do You Need To Be An Insurance Agent Can Be Fun For Anyone

By this I mean, if you allow the customers to inform you what they require and what they're doing and follow their orders, this isn't for you. As an Insurance Representative, it's your job to inform customers, "paint the picture" by giving real life examples, evaluate each person's circumstance and make recommendations that remain in the very best interest of the client. offer policies that protect individuals and organizations from financial loss resulting from auto accidents, fire, theft, and other events that can damage home. For businesses, home and casualty insurance likewise covers employees' settlement claims, item liability claims, or medical malpractice claims. specialize in selling policies that pay beneficiaries when a policyholder passes away.

offer policies that cover the expenses of healthcare and https://apnews.com/Globe%20Newswire/8d0135af22945c7a74748d708ee730c1 assisted-living services for seniors. They also might offer oral insurance coverage and short-term and long-term impairment insurance coverage. Agents might specialize in selling any one of these items or function as generalists offering numerous items. An increasing number of insurance sales agents offer their clientsespecially those approaching retirementcomprehensive financial-planning services, consisting of retirement planning and estate planning.

This practice is most typical with life insurance representatives who already offer annuities, but many residential or commercial property and casualty representatives also sell financial items. how to become insurance agent. Many representatives spend a lot of time marketing their services and producing their own base of clients. They do this in a variety of methods, including making "cold" sales contacts us to people who are not existing clients.

Clients can either purchase a policy straight from the company's website or contact the company to speak to a sales representative. Insurance agents likewise find new customers through recommendations by present clients. Keeping customers happy so that they suggest the representative to others is an essential to success for insurance coverage sales representatives.

are insurance sales agents who work specifically for one insurance coverage company. They can only offer policies supplied by the business that utilizes them. work for insurance coverage brokerages, selling the policies of numerous companies. They match insurance coverage for their customers with the business that offers the best rate and protection.

6 Easy Facts About How To Be Insurance Agent Explained

$ 20,000 - $33,99911% of jobs $34,000 - $47,99912% of jobs $50,000 is the 25th percentile. Incomes listed below this are outliers.$ 48,000 - $61,99917% of tasks $62,000 - $75,99917% of jobs The average wage is $79,730 a year$ 76,000 - $89,99913% of jobs $99,500 is the 75th percentile. Wages above this are outliers.$ 90,000 - $103,99915% of jobs $104,000 - $117,9993% of jobs $118,000 - $131,9994% of tasks $132,000 - $145,9990% of jobs $146,000 - $159,9992% of tasks $160,000 - $174,0000% of tasks.

For the most part, life insurance coverage agents won't charge you anything if you work with them to buy life insurance. So how do they get paid? Most representatives make a portion of the premiums on life insurance coverage policies they sella rather than a set income. That commission, nevertheless, does not come at an additional cost to you since Insurance coverage prices are managed by each state's department of insurance.

Since these rates are set beforehand, a representative can't provide you one business's policy at a various rate than you 'd get by merely going to the company itself. These pre-set commission rates are another reason window shopping is so essential when buying life insurance coverage to protect the most affordable cost.

Even simply researching your choices is typically a difficulty: Various resources might have clashing or incorrect details, particularly as federal and state insurance coverage laws alter each year. It's a representative's task to assist you navigate all the nuances of life insurance and guide you through the procedure of purchasing a policy.

A representative can upgrade you as your application advances with the insurance provider and handle the backward and forward so you don't have to. It's likewise helpful for someone to have all your info on file in case your application gets decreased, which might happen if you stop working to reveal medical conditions or if a business considers you too risky to be covered.

Indicators on How To Become An Allstate Insurance Agent You Need To Know

Agents who can use you multiple kinds of insurance, such as impairment insurance, might even be able to recycle your info across applications if you need more protection. An excellent life insurance coverage representative will understand which policies best match your individual scenario and steer you toward the finest choice. However relying solely on an agent's know-how also implies you're at a disadvantage if they misinform you about just how much or what type of protection you need.

If you don't purchase a policy, they don't earn money. And since of the method commission works, the more pricey a policy you purchase, the more the agent earns money. You could be roped into a life insurance policy that uses method more protection than you require, with premiums much greater than you 'd spend for the suitable quantity of coverage.

Not exactly sure just how much life insurance coverage you might need? Our life insurance coverage calculator will offer you a tailored suggestion. We can also https://www.globenewswire.com/news-release/2020/03/12/1999688/0/en/WESLEY-FINANCIAL-GROUP-SETS-COMPANY-RECORD-FOR-TIMESHARE-CANCELATIONS-IN-FEBRUARY.html help you compare quotes from numerous insurance providers. Come armed with that info when you're all set to fulfill a representative, and you will not require to accept the very first offer.

Insurance is an amusing profession. It's a career that no one ever wants to be when they are 8 years of ages, nor is it a profession they desire to be in when they are 23 and preparing yourself to finish college. (Yes it took me 5 years to finish college let the Tommy Young boy jokes start.) At some time something occurs.

Whether your family owned a company for several years or you encountered a Certainly. com Task opportunity, like I did, you begin to love it. You start to see the possibilities for you and your household. I at first began dealing with an excellent State Farm workplace due to the fact that I seen the prospective the industry had for me.

All about How To Become An Independent Auto Insurance Agent

I can be with my growing household whenever they required me. My WHY was flexibility. A little over 4 years later on my why has actually completely altered. With a beautiful other half, 2 terrific children (soon to be 3), flexibility is no longer my why but merely an advantage of this career that I enjoy a lot.

I started working at a State Farm Company at the age of 25 with my lovely wifey, Jocelyn, anticipating our first kid, Payton. There, I truly started to enjoy dealing with individuals and assisting them with their needs. Within a short time I discovered a great person to follow by the name of Dave Ramsey.

I'm not going to explain why I do not like whole life insurance coverage on this post, but if you want to understand more information about why I'll select Term Life Insurance coverage 99. 9% of the time for my clients, Click Here. I understood I had to move on.

After a year of dealing with State Farm I started my career as an independent insurance coverage agent working under an excellent representative that I discovered a remarkable amount from. I was lastly free! Free to work with the clients I wanted to work with, offer the items that I thought in, and genuinely have the flexible schedule that I wanted for my family.

The Of How Much Does An Insurance Agent Make Per Policy

So how do you become a life insurance coverage representative and what do you need to understand? We will explore more in this article. You don't need to have actually pursued college to become a life insurance coverage agent. In a lot of states, you just require to have a high school diploma and be 18 years of age or older, with many states needing a licensing course and examination.

1 in 5 Americans consider themselves uninsured or underinsured when it comes to life policies so there are millions of people to help. 2 It is possible to acquire an insurance license without applying with a business, however you can also acquire your license by applying straight with the life insurance coverage firm or business of your choice and following their application procedure.

Becoming a certified life insurance representative is a matter of passing a background check, and taking the licensing course and qualifying exam, and passing. After, you will be able to request your license. Not every state needs license in order to offer policies, however numerous do. Some companies will assist you obtain your licensing as part of bringing you on to the team.

The time dedication for taking the pre-licensure course varies from state-to-state, however an average length of time is around 20 hours3 with a multi-hour examination you'll have to sit for. After you finish the training and exam (and pass the exam), you'll be certified to offer insurance coverage in the state you have actually taken the examination in.

The Ultimate Guide To Why Independent Insurance Agent

This requirement will depend upon what state you remain in, and the amount of continuing education required differs. Contact your specific state's Department of Insurance for these requirements. Becoming a certified life insurance coverage agent can take as little as a couple of days to a number of weeks to get licensure to sell insurance coverage.

Becoming a life insurance agent can be a gratifying career to enter, as there are lots of individuals who need the security life insurance coverage might help provide. The timeframe for starting in this profession will depend on where you live and how driven you are to master and complete any state- or company-mandated requirements.

Last Updated: August 13, 2019 Insurance coverage representatives research and offer life, health, house, vehicle and other insurance plan to people and organizations. They make a commission for generating new business, paid by the insurance provider. This post will tell you how to become a successful insurance coverage representative.

This post will cover all steps of how to become an insurance coverage representative. As a result, it will cover all actions included to end up being a representative and how to succeed in business. In addition, it will cover the numerous types of insurance coverage representatives consisting of captive agents, independent agents and company owners to call a couple of.

Little Known Facts About How Much Does A State Farm Insurance Agent Make.

If it was, everybody would be doing it. It takes effort to begin and remain in the insurance business. This post is based upon my experience as a sales individual and now a firm owner. I have utilized my individual experience to use you genuine examples and recommendations. Absolutely nothing in the list below is hypothetical.

I have actually listed a number of errors I have made along the way, in hopes you can prevent them and save both time and money. If your are only searching for access to sales agreements and contract at complete street commission or greater click here for contracting. Insurance license Best methods to obtain a license Type of license required Taking the test Errors and timeshare lawyer services Omissions Insurance coverage Why you need it and where to get it Various sort of insurance coverage representatives Identify which kind of representative you will be Type of items sold How lots of product types and companies you will sell Marketing strategy and leads Methods to write business/gain clients different types of leads Settlement Street compensation Assigned payment Book of company Other topics Quote engines Back office assistance Application submission/processing General Agencies The initial step in how to end up being an insurance agent is to have a legitimate insurance license in the states you will be selling in.

The requirements differ somewhat from one state to another. In general, you must pass a pre-licensing examination. When the you pass the pre licensing test you can take the insurance examination. State controlled screening centers such as, Pro-Metric will administer the Insurance coverage examinations. After passing the test, the agent can request a license through the respective state insurance coverage department.

This blog site will focus on how to become an insurance coverage agent as a Life, Mishap and health representative, which need a Life, Accident and Health License. Other licenses are required for other lines of business such as Property & Casualty, Variable life products and securities. There are a variety of methods to study for the exam.

The Single Strategy To Use For How To Become An Insurance Agent In California

Others depend on book research study and online classes to prepare. In my viewpoint, classes are not a great usage of cash. The most westley group cost reliable method to study for a licensing examination is by ordering a book and using the online research study concerns. Most states require that you take A pre licensing course - how to become independent insurance agent.

They likewise use an excellent value on the licensing test research study product. I would recommend buying the research study guide and accessing the online bank of previous test questions. You need to set up a test date at the specific state testing area. Locations/companies differ by state. An example is Prometric in Connecticut.

There are charge's for taking the exam and apply for the license. The amouts depend on the state you are in. Our company offers repayments for new agents getting their insurance license. Click on this link for more information about test and license charge compensation. Some states will require finger prints on file in order to get the license.

Acquiring extra licenses for non resident states is simple. Go to the National Insurance Coverage Manufacturer Registry site and obtain the required states without the requirement for extra screening. Note: You can sell some non insurance coverage based items without an insurance https://elliothytg460.shutterfly.com/31 license. Examples are Healthshare ministry strategies and discount rate products.

Examine This Report about How Much Does It Cost To Become An Insurance Agent

In general, E & O helps secures guidance and service bases sales individuals versus paying for the full expense of negligence claims made by prospects and customers. A lot of business need agents to have E & O insurance coverage in order to get an agreement to offer their product. Some business such as Final Cost carriers will permit representatives to become contracted (likewise called selected) without E and O.

The Greatest Guide To How Much Does A Farmers Insurance Agent Make

All of these things talked about, particularly earnings and time, enable the insurance coverage representative to return to their neighborhoods. Many insurance agents are really charitable. They donate money to various causes. They utilize their time to serve others in their communities. They are proactive, oftentimes, in other causes outside their insurance organization.

After you end up being an effective insurance agent, you can assist teach and train new representatives coming into business. If you like to coach others, or teach and train by sharing your understanding, you can help others in the company. Show them what you did to end up being successful. Assist them get a start in business.

He and his spouse had moved out of state and I had lost contact with them. Then out of the blue he sent me a text informing me he had actually discovered his niche in business insurance and thanked me for assisting him start and teaching him; it was a fulfilling message I get from that young man.

The Facts About What Is An Insurance Agent Uncovered

For me, solving problems and helping individuals is the most satisfying part of my career. Constructing a personnel and assisting them work towards their dreams and objectives has likewise been really fulfilling for me. how much does a life insurance agent make a year. If you are a young college student questioning what you wish to finish with your life think seriously about insurance coverage.

Its difficult, its tough however the benefits are rich. What could be better than assisting others while earning a living and having the time to do what you wish to perform in life.

Honestly, people view Insurance coverage Representatives in the exact same light they see used automobile salespersons! The majority of people do not understand the importance of insurance Additional info and feel like they're spending for something they'll most likely never need. Do not get me wrong, I absolutely have clients who are firm believers in guaranteeing anything and everything possible, however, a lot of clients believe I'm trying to offer them something they don't actually require just to get a commission.

6 Simple Techniques For How To Become An Insurance Agent In Massachusetts

If you triggered a significant automobile accident and you disabled a person in another cars and truck, how would you feel if you lost your home over it? If you suddenly died tomorrow, how would you feel if your household had a hard time to pay the expenses and your children didn't have money to go to college? What would you do if your entire home was destroyed in a flood? These things are difficult for the majority of people to fathom, nevertheless, they happen each and every single day.

I examine a customer's needs and make recommendations based on their assets, their budget, life events, and so on - how do you become an insurance agent. I likewise help https://griffinpjgy497.webs.com/apps/blog/show/49284240-10-simple-techniques-for-how-much-does-an-insurance-agent-make service existing accounts and connect to customers occasionally to make certain their scenario hasn't changed. For example ... have they gotten wed? Had an infant? Altered jobs? Has their teen gotten a license? All of those things set off a need to examine your insurance program.

Every day as an Insurance coverage Representative is various! I typically have a plan in location for what I wish to accomplish every day but that hardly ever goes as expected! I begin my day by calling any person who hasn't paid their insurance coverage and letting them know that it's in difficulty of lapsing and recommend of any possible penalties.

All About How To Become Licensed Insurance Agent

I address billing questions, protection concerns and make modifications to policies. If a customer purchases a brand-new vehicle, I add it to their policy. If they're purchasing a new home, I work with their loan officer to get a policy ready prior to settlement - how to become an independent auto insurance agent. I also go out to the house and inspect the outdoors to ensure there aren't any hazards.

If someone calls in and asks why their renewal premium is increasing, I research this, let them understand why and then make recommendations to offset the exceptional boost. When a client hires to see if they can get a lower premium, I explain each of the discount rates available to them and advise how much they could conserve.

For instance, do they still require full coverage on that 20 year old lorry? Can they deal with a $250 deductible instead of $100. I then include discounts/make coverage modifications they have an interest in. I offer regular reviews to my customers to discuss their policies in detail to ensure their protection is appropriate and that they comprehend what they're paying for and getting all the discounts they're eligible for.

Some Known Facts About Who Does An Agent Represent During The Solicitation Of Insurance.

I follow up with clients after a claim remains in motion to make sure whatever is running smoothly and see if they have any concerns or issues. I deal with underwriters to gather extra information from customers when required. For example, maybe an insured automobile isn't drawing in as being registered to the client.

I also help customers determine just how much Life Insurance coverage they need by completing what we call a "Needs Analysis". We go through what they would wish to accomplish if they died .. - how to become an insurance agent in ga. do they wish to put their kids through college? Do they desire their spouse to pay off the home? Have some additional in cost savings? Pay off any debts such as charge card, lorry loans, and so on.

I would state about $50,000-$ 60,000 To end up being an Insurance Agent, you need a license in the state in which you want to do business. Each state has different requirements but for the a lot of part, you will require to either take a More help class (2 days - 1 week) or finish a Self Study course and then pass a state test.

How How To Become A Insurance Agent In Texas can Save You Time, Stress, and Money.

If you want to sell the fundamentals such as Home, Vehicle, Boat, Motorbike, etc; you would need what's called a Residential or commercial property & Casualty License. If you want to enter offering Life & Medical insurance, you require a different license for this which needs a separate exam. You can also take it even more and get your Variable License.

This license provides you the authority to sell variable products such as annuities, mutual funds, and so on. A lot of Insurance coverage Agencies will hire you even if you do not have a license yet, with the understanding that you will get one in an agreed quantity of time. Typically while you're studying for your license, you'll find out the ins and outs of the company you're working for and the daily operations and treatments.

It is very important to keep in mind that without a degree, you can still do effectively as an Insurance Agent. You have the alternative to work for a Primary Representative, or even end up being an Independent Representative and open your own agency if you have the capital to acquire an independent company or motivation to build an agency from scratch.

The How To Find A Good Insurance Agent Diaries

They require a certain quantity of Continuing Education Credits either yearly or bi-annually. Without these credits you will be not able to restore your license. You can get these credits through live classes or self study courses. The courses typically relate to Insurance Basics, Ethics, Coverages, Flood Rules, Anti-money Laundering, and so on.

While every company pays in a different way, a great deal of Insurance coverage Agents are paid a really small base pay and commissions on the sales they make. They are also generally offered sales requirements. If you're not a "sales representative", accepting a task that pays largely on commission may not be an excellent concept.

How Long Does It Take To Get Life Insurance - An Overview

Term life insurance is frequently the most affordable, because the rate of your premium is secured for the term you select. Payments are made month-to-month or annual. The amount of your premium differs according to your health and other aspects. Term life insurance coverage premiums will be lower than premiums for most entire life insurance coverage policies, which last a lifetime and build cash value.

Whole life insurance coverage typically features ensured level premiums the quantity will never ever change as long as premiums are paid. Whole life insurance policies pay death advantages (earnings after death) and they might likewise construct cash value. Cash worth is the additional money you can contribute (above the cost of the insurance plan) that can grow tax-deferred as a financial investment.

The amount you pay will depend on how much coverage you desire. Likewise factored into the cost are your age, gender and health, to name a few factors to consider. Generally, you must consider a term life insurance coverage policy to: Get important coverage at competitive rates Assist cover specific monetary obligations Click to find out more like a mortgage or college costs Supplement an irreversible policy or policy through your employer Consider a whole life insurance policy if you want: Portable protection for life Level premiums that remain the same each year To contribute extra money above the cost of insurance coverage into the policy on a tax-deferred basis Money worth you can use during your lifetime Please keep in mind that these are simply guidelines.

Picture credit: iStock/KaeArt The market for life insurance is one clouded by misunderstandings. The first has to do with expense. Consumers think life insurance coverage costs nearly 3 times as much as it really does, according to the life insurance coverage research group LIMRA. That's a quite large gap. Picture, for instance, if consumers overstated the price of milk by a similar amount: at over $10 a gallon, a number of us would abandon the 2% and start putting orange juice over our cereal.

Just behind that is the issue of complexity. The variety of life insurance options is as huge as the vocabulary utilized to describe them: variable life insurance, universal life insurance, variable universal life, term life, home loan life, lump amount, decreased paid-upand on and on. This is a hard maze to browse, and frustration is typical.

Getting My What Is Cash Value Life Insurance To Work

Nobody, after all, desires to get ripped off. Yes thank you for that helpful analogy! In some methods, buying life insurance is a lot like purchasing a car. Both are investments that will be with you for several years, and both cost you a reasonable quantity of money. You may have a basic idea of what you desire at the beginning, but unless you're a specialist (i.e.

In addition, it can be hard to inform the reputable experts from the salesmen. Unless you have a trustworthy outside consultant (and they can be costly) you have little option but to believe what you're hearing. So, just like purchasing a car, the finest thing you can do is arm yourself with a bit of knowledge about the products you are thinking about - how does whole life insurance work.

That method, when it's time to make a purchase, you can be confident you're getting the ideal thing based on an informed life insurance contrast. How much you spend for your life insurance will depend on factors consisting of personal information (like age and health) and policy types. An online tool can supply instantaneous life insurance coverage prices quote so you can have a concept of what you will pay for what kind of coverage.

We just so happen to have one for you (what are the odds !?!) right at the top of this page. But if you're trying to find help making some decisions, we've got that for you, too. which of the following best describes term life insurance?. The most standard divide in the life insurance coverage world is that in between Term Life Insurance and Permanent Life Insurance Coverage.

The difference is a matter of time: one (permanent) lasts for life, and the other (term) lasts for a finite duration, agreed upon at the beginning. Because long-term life insurance coverage enables you to secure a rate throughout, it is typically more costly than an equivalent term policy.

5 Simple Techniques For What Does Term Life Insurance Mean

Insurance policy holders can borrow against the money cost savings in their strategy, or use the cost savings to pay premiums. The main advantage of a permanent policy, nevertheless, is that it allows you to ensure that, whatever happens to you for the rest of your life, you will be guaranteed, so long as you continue making your payments (when to get life insurance).

The advantage of a term policy is that it allows you to prepare your coverage around life events. If, for instance, you have actually just had a kid, you can purchase 20-year term life insurance so that if something occurs to you before your kid leaves home, she or he will be looked after.

With a Return of Premium policy, the premiums you pay are set aside and went back to you completely at the end of your term, whereas a Level policy includes no such guaranteeyour premiums, when paid, are gone. For that reason, Return of Premium policies are the more expensive of the two.

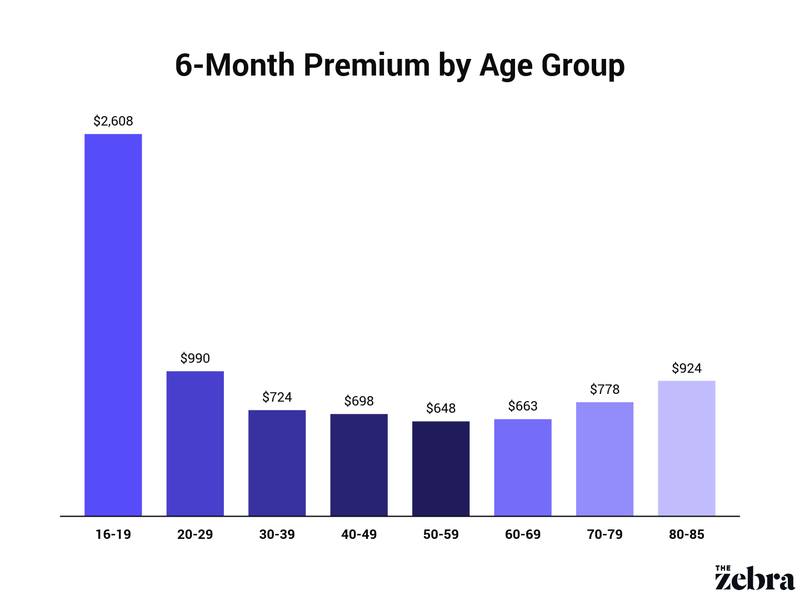

Insurance provider need to know how most likely they are to pay your coverage quantity: the greater that probability, the higher your premium. That's why life insurance coverage rates vary so widely by age. The older you are, the more you can expect to pay. Although they mainly consider the very same elements, life Visit this page insurance suppliers can quote vastly various premiums on similar policies.

While Alpha Life, Inc. might believe your age is most essential, Beta Insurance Co. might offer more weight to your outstanding health. And simply as each life insurance coverage company has its own way of determining premiums, each life insurance coverage business runs in an unique way, under distinct financial conditions, and with its own set of guidelines for how to do company.

What Is A Corridor In Relation To A Universal Life Insurance Policy? for Dummies

There are little and big business, national and local insurance companies, each with its own strengths and weak points. These are some things to think about, in addition to the real prices, when taking a look at life insurance quotes. Picture credit: iStock/BraunS Definitely. To start, let's find some insurance coverage for Jane. She's 25 years old, in excellent health, and resides in stunning Ocean City, New Jersey.

She decides the best policy for her would be a 20 year level term policy. At that protection quantity, and with those specs, she can get a policy for in between $12 and $17 each month. Plus, she's got options: nine various insurance coverage companies have a policy within that rate range, according Additional reading to our Life Insurance Quotes tool above.

Dale is 60 years of ages, and he desires to be covered for the rest of his life. He remains in typical health and he smokes. He wants a benefit of $400,000 to go to his wife and kids if anything occurs to him. His policy is going to cost more than Jane' ssomewhere in between $1,240 and $1,588, depending upon which company he chooses to purchase from.

The Main Principles Of What Is Universal Life Insurance

Table of ContentsTop Guidelines Of How Much Life Insurance Do You NeedWhat Is The Best Life Insurance Policy - TruthsWhen Must Insurable Interest Exist For A Life Insurance Contract To Be Valid? Can Be Fun For AnyoneThings about What Does The Ownership Clause In A Life Insurance Policy State?How Many Life Insurance Policies Can You Have - Truths

Life insurance coverage can pay funeral service and burial expenses, probate and other estate administration costs, financial obligations and medical costs not covered by medical insurance. Even those without any other possessions to pass on, can develop an inheritance by buying a life insurance policy and naming their beneficiaries as recipients. Life insurance coverage benefits can pay for estate taxes so that heirs will not need to liquidate other possessions or take a smaller inheritance.

By making a charity the recipient of their life insurance policies, people can make a much larger contribution than if they donated the money equivalent of the policy's Visit this page premiums. Some kinds of life insurance produce a cash worth that, if not paid out as a death advantage, can be borrowed or withdrawn on the owner's demand.

Furthermore, the interest credited is tax deferred (and tax exempt if the cash is paid as a death claim). There are 2 significant kinds of life insuranceterm and whole life. Term insurance is the most basic kind of life insurance coverage. It pays just if death takes place throughout the term of the policy, which is normally from one to 30 years.

There are two fundamental kinds of term life insurance policieslevel term and decreasing term. Level term means that the survivor benefit remains the same throughout the period of the policy. Reducing term suggests that the death advantage drops, normally in one-year increments, over the course of the policy's term. Entire life or permanent insurance coverage pays a survivor benefit whenever the policyholder passes away.

10 Easy Facts About What Is The Best Life Insurance Policy Shown

When it comes to conventional entire life, both the death benefit and the premium are designed to stay the exact same (level) throughout the life of the policy. The expense per $1,000 of benefit boosts as the guaranteed person ages, and it clearly gets really high when the guaranteed lives to 80 and beyond.

By law, when these "overpayments" reach a certain amount, they should be available to the insurance policy holder as a money value if she or he chooses not to continue with the original plan. The money value is an alternative, not an additional, advantage under the policy. Universal life, likewise called adjustable life, permits more versatility than traditional whole life policies.

After cash has actually accumulated in the account, the policyholder will also have the choice of modifying premium paymentsproviding there is sufficient money in the account to cover the costs. Variable life policies integrate death defense with a savings account that can be purchased stocks, bonds and money market mutual funds.

If investments do not carry out http://elliothrcx179.trexgame.net/all-about-how-to-cancel-life-insurance well, the cash value and death advantage may reduce. Some policies, however, warranty that the death advantage will not fall listed below a minimum level (how does life insurance work). Another version, universal variable life, integrates the features of variable and universal life policies. It has the financial investment dangers and rewards characteristic of variable life insurance coverage, combined with the capability to change premiums and survivor benefit that is characteristic of universal life insurance.

4 Simple Techniques For Whose Life Is Covered On A Life Insurance Policy That Contains A Payor Benefit Clause?

Lots of or all of the items featured here are from our partners who compensate us. This may influence which products we blog about and where and how the item appears on a page. Nevertheless, this does not influence our assessments. Our opinions are our own. Life insurance coverage is a contract between you and an insurance provider.

In exchange, the business pays a survivor Hop over to this website benefit to your recipients when you pass away. There are essentially 2 types of life insurance: term life and permanent life. Term life covers you for a repaired amount of time while irreversible life insurance covers you till completion of your life. Normally, term life insurance is less expensive to buy than long-term life.

Term life policies have no value if you outlive the contract. Initially designed to help cover burial expenses and care for widows and orphans, life insurance is now a flexible and effective monetary product. Majority of Americans have some sort of life insurance, according to insurance research study organization LIMRA.

We'll be taking a look at private policies, not the group life insurance typically provided through work. Life insurance policies can vary commonly. There's life insurance for households, high-risk purchasers, couples and numerous other specific groups. Even with all those differences, most policies have some common characteristics. are the payments you make to the insurance provider.

The Ultimate Guide To How To Find Out If Someone Has Life Insurance

With a long-term policy, you'll also be able to pay cash into a cash-value account. are the individuals who receive cash when the covered individual dies. Selecting life insurance recipients is an essential step in planning the effect of your life insurance coverage. Recipients are typically partners, children or moms and dads, however you can choose anyone you like.

You select a money value when you purchase a policy, and the quantity is sometimes however not constantly a fixed worth. Permanent life insurance coverage can likewise pay additional money if the cash account has grown and if you select specific options for your policy. are choices you can contribute to a life insurance policy.

By spending for a rider, you can add those and other functions to your policy. Like all insurance, life insurance was designed to solve a monetary issue. Life insurance coverage is essential because when you die, your income disappears. If you have a spouse, kids or anyone reliant on you economically, they're going to be left without assistance.

That can suggest your partner, kid or relatives will have to spend for burial and other end-of-life expenses. As you consider the amount of life insurance protection you need, consider your recipients and what they'll require. If nobody depends upon your income and your funeral expenditures won't damage anyone's finances, life insurance may be a thing you can avoid.

About How Is Life Insurance Taxed

The quantity of life insurance coverage you require depends on what you're attempting to do. If you're just covering end-of-life expenditures, you will not require as much as if you're attempting to replace lost income. The calculator listed below can assist you approximate the total protection you may require. If you're interested in a permanent policy (more on these below), you ought to also connect with a fee-only financial consultant.

Term life insurance coverage is coverage that lasts for an amount of time chosen at purchase. This kind of life insurance coverage typically covers 10-, 20- and even 30-year durations (what is life insurance). If you pass away throughout the covered period, the policy will pay your beneficiaries the amount mentioned in the policy. If you don't pass away throughout that time frame, nobody makes money.

It's likewise a momentary solution. It exists for the very same factor short-term tattoos and hair dyes do often a bit is long enough. Reasons you may want term life insurance include: You wish to ensure your kid can go to college, even if you pass away. You have a home mortgage that you do not wish to saddle your partner with after your death.

There are some variations on common term life insurance policies. Convertible policies allow you to convert them to irreversible life policies at a higher rate, permitting longer, more versatile protection. Decreasing term life policies have a death benefit that decreases in time, frequently lined up with home mortgages or big financial obligations that are gradually paid off.

Things about How Long Does Nicotine Stay In Your System Life Insurance

Table of ContentsThe Main Principles Of What Is A Corridor In Relation To A Universal Life Insurance Policy? Top Guidelines Of How Much Is Life Insurance For A 55 Year Old?The Definitive Guide for What Is Whole Life InsuranceThe smart Trick of Why Buy Life Insurance That Nobody is Discussing

1Rates cancel my timeshare contract are illustrative only. Please do not submit cash. You must first get an application to obtain any protection. Premium based upon the Level Benefit Strategy private rate for a female non-tobacco user in Alabama, age 55, with a $10,000 advantage quantity. Private rates will vary based upon your state, age at time of problem, sex, tobacco status and the benefit quantity you select.

Unisex uses to Montana just. 3 2Benefit quantities might differ by state and all benefits payable are subject to the conditions of the policy and/or rider. 3Subject to all the terms of the policy and/or rider. 4Only offered if both people use at the same time.

5Premium based upon the Level Advantage Strategy private rate for a female non-tobacco user in Alabama, age 55, with a $10,000 advantage amount. Private rates will differ based upon your state, age sometimes of problem, sex, tobacco status and the advantage quantity you choose. Rates undergo alter.

This website is designed as a marketing aid and is not to be construed as a contract for insurance (how do life insurance companies make money). It offers a brief description of the important functions of the policy. Complete conditions of protection are specified by and governed by a released policy. Please describe the policy for the complete conditions of protection.

All insurance coverage policies might contain exclusions, restrictions, reduction of benefits, and terms under which the policy may be continued in force or stopped. For expense and total information of coverage, contact your insurance agent or the company. Cancer Treatment, Lump Amount Cancer, Lump Sum Cardiac Arrest and Stroke and Person Whole Life Insurance Policies are insured by Devoted American Life Insurance Company.

The Swelling Sum Heart Attack and Stroke policy is not offered in MA or VA. The Individual Whole Life insurance coverage policy is not readily available in FL or MT - how does life insurance work.

Not known Details About How To Calculate Cash Surrender Value Of Life Insurance

A life insurance coverage beneficiary is the person, people, trust, charity or estate who gets the payout on your life insurance policy after you die. You'll usually be asked to pick 2 sort of https://postheaven.net/wulverod4h/b-table-of-contents-b-a-92p5 beneficiaries: a primary and a secondary. The secondary recipient, likewise called a contingent recipient, receives the payout if the main recipient is deceased.

There are special considerations when it concerns offering for minors as well as calling a charity or your estate as a life insurance coverage beneficiary.

Share of LTCI Claims Beginning with Nursing Care Falls: AALTCI", ThinkAdvisor, Allison Bell April 20, 2018 Read this important details Your life insurance coverage requirements may alter if your personal scenario changes. For instance, if you get married, have a child or get a promo, you may desire to increase your coverage.

Also, make certain you are able to continue exceptional payments so your policy does not lapse if the market decreases. If you take a loan, withdrawal or partial or whole surrender your survivor benefit might be decreased, your policy might lapse or you might deal with tax consequences. There are charges and charges for variable life insurance protection, including an expense of insurance based upon characteristics of the insured person, such as gender, health and age.

Investing involves risks, consisting of possible loss of principal. Neither Nationwide nor its representatives provide legal or tax advice. Please consult your attorney or tax consultant for responses to particular concerns. Guarantees and defenses go through Nationwide's claims-paying capability. They don't apply to the financial investment efficiency or security of the underlying investment options.

Whole-life policies, a type of irreversible insurance coverage, combine life coverage with an investment fund. Here, you're buying a policy that pays a specified, repaired quantity on your death, and part of your premium goes towards constructing cash value from investments made by the insurer. Money value constructs tax-deferred each year that you keep the policy, and you can obtain versus the cash build-up fund without being taxed.

All about What Is Group Term Life Insurance

Universal life is a type of long-term insurance coverage that combines term insurance with a cash market-type investment that pays a market rate of return. To get a greater return, these policies normally do not guarantee a certain rate. Variable life and variable universal life are permanent policies with a mutual fund connected to a stock or bond mutual-fund financial investment.

A term policy is straight insurance with no investment component. You're purchasing life coverage that lasts for a set time period offered you pay the regular monthly premium. Annual-renewable term is bought year-by-year, although you do not need to requalify by revealing proof of health each year. When you're young, premiums for annual-renewable term insurance are dirt low-cost-- as low as a few hundred dollars per year for $250,000 worth of coverage.

Level-premium term has rather higher-- but fixed-- premiums for longer periods, anywhere from 5 to 30 years. CNNMoney (New York) First released Might 29, 2015: 12:33 PM ET.

The Federal Government established the Federal Worker' Group Life Insurance Coverage (FEGLI) Program on August 29, 1954. It is the biggest group life insurance coverage program in the world, covering over 4 million Federal workers and retirees, in addition to a lot of their household members. Most employees are qualified for FEGLI coverage.

As such, it does not develop any money worth or paid-up worth. Home page It consists of Basic life insurance coverage and three choices. For the most part, if you are a new Federal worker, you are immediately covered by Standard life insurance and your payroll office subtracts premiums from your income unless you waive the coverage.